This post was originally published on this site

Taxes can take a big bite out of your total investment

returns, so it’s helpful to look for tax-advantaged strategies when building a

portfolio. But keep in mind that investment decisions shouldn’t be driven

solely by tax considerations; other factors to consider include the potential

risk, the expected rate of return, and the quality of the investment.

Tax-deferred and tax-free investments

Tax deferral is the process of delaying (but not necessarily

eliminating) until a future year the payment of income taxes on income you earn

in the current year. For example, the money you put into your traditional 401(k) retirement

account isn’t taxed until you withdraw it, which might be 30 or 40 years down

the road!

Tax deferral can be beneficial because:

- The money you would have spent on taxes remains invested

- You may be in a lower tax bracket when you make

withdrawals from your accounts (for example, when you’re retired) - You can accumulate more dollars in your accounts due to

compounding

Compounding means that your earnings become part of your

underlying investment, and they in turn earn interest. In the early years of an

investment, the benefit of compounding may not be that significant. But as the

years go by, the long-term boost to your total return can be dramatic.

Taxes make a big difference

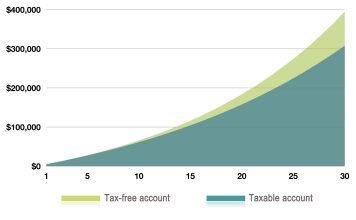

Let’s assume two people have $5,000 to invest every year for

a period of 30 years. One person invests in a tax-free account like a Roth

401(k) that earns 6% per year, and the other person invests in a taxable

account that also earns 6% each year. Assuming a tax rate of 24%, in 30 years

the tax-free account will be worth $395,291, while the taxable account will be

worth $308,155. That’s a difference of $87,136.

This hypothetical example is for illustrative purposes only,

and its results are not representative of any specific investment or mix of

investments. Actual results will vary. The taxable account balance assumes that

earnings are taxed as ordinary income and does not reflect possible lower

maximum tax rates on capital gains and dividends, as well as the tax treatment of investment losses, which would make the taxable

investment return more favorable, thereby reducing the difference in

performance between the accounts shown. Investment fees and expenses have not

been deducted. If they had been, the results would have been lower. You should

consider your personal investment horizon and income tax brackets, both current

and anticipated, when making an investment decision as these may further impact

the results of the comparison. This illustration assumes a fixed annual rate of

return; the rate of return on your actual investment portfolio will be

different, and will vary over time, according to actual market performance.

This is particularly true for long-term investments. It is important to note

that investments offering the potential for higher rates of return also involve

a higher degree of risk to principal.

Tax-advantaged savings vehicles for retirement

One of the best ways to accumulate funds for retirement or

any other investment objective is to use tax-advantaged (i.e., tax-deferred or

tax-free) savings vehicles when appropriate.

-

Traditional IRAs

— Anyone who earns

income or is married to someone with earned income can contribute to an IRA.

Depending upon your income and whether you’re covered by an employer-sponsored

retirement plan, you may or may not be able to deduct your contributions to a

traditional IRA, but your contributions always grow tax deferred. However,

you’ll owe income taxes when you make a withdrawal.* You

can contribute up to $7,000 (for 2024 and 2025) to an IRA, and individuals age 50 and older can

contribute an additional $1,000 (for 2024 and 2025). -

Roth IRAs

— Roth IRAs are open only to individuals with incomes below certain limits. Your contributions are made with after-tax dollars but will grow tax deferred, and qualified distributions will be tax free when you withdraw them. The amount you can contribute is the same as for traditional IRAs. Total combined contributions to Roth and traditional IRAs can’t exceed $7,000 (for 2024 and 2025) for individuals under age 50. -

SIMPLE IRAs and SIMPLE 401(k)s

— These plans are generally associated with small businesses. As with traditional IRAs, your

contributions grow tax deferred, but you’ll owe income taxes when you make a

withdrawal.* You can contribute up to $16,500 (for 2025, $16,000 for 2024) to one of these plans;

individuals age 50 and older can contribute an additional $3,500 (for 2024 and 2025), increased to $5,250 in 2025 for individuals age 60 to 63.

(SIMPLE 401(k) plans can also allow Roth contributions.) -

Employer-sponsored plans (401(k)s, 403(b)s, 457

plans)

— Contributions to these types of plans grow tax deferred, but

you’ll owe income taxes when you make a withdrawal.* You can

contribute up to $23,500 (for 2025, $23,000 for 2024) to one of these plans; individuals age 50 and older

can contribute an additional $7,500 (for 2024 and 2025), increased to $11,250 in 2025 for individuals age 60 to 63.

Employers can generally allow employees to

make after-tax Roth contributions, in

which case qualifying distributions will be tax free. -

Annuities

— You pay money to an annuity issuer (an insurance company), and the issuer promises to pay principal and earnings back to you or your named beneficiary in the future (you’ll be subject to fees and expenses that you’ll need to understand and consider). Most annuities have surrender charges that are assessed if the contract owner surrenders the annuity. Annuities generally allow you to elect to receive an income stream for life (subject to the

financial strength and claims-paying ability of the issuer). There’s no limit to how much you can

invest, and your contributions grow tax deferred. However, you’ll owe income

taxes on the earnings when you start receiving distributions.*

Tax-advantaged savings vehicles for college

For college, tax-advantaged savings vehicles include:

-

529 plans

— College savings plans and prepaid

tuition plans let you set aside money for college that will grow tax deferred

and be tax free at withdrawal at the federal level if the funds are used for

qualified education expenses. These plans are open to anyone regardless of

income level. Contribution limits are high — typically over $300,000 — but vary

by plan. -

Coverdell education savings accounts

— Coverdell

accounts are open only to individuals with incomes below certain limits, but if

you qualify, you can contribute up to $2,000 per year, per beneficiary. Your

contributions will grow tax deferred and be tax free at withdrawal at the

federal level if the funds are used for qualified education expenses. -

Series EE bonds

— The interest earned on Series EE

savings bonds grows tax deferred. But if you meet income limits (and a few

other requirements) at the time you redeem the bonds for college, the interest

will be free from federal income tax too (it’s always exempt from state tax).

Investors should consider the investment

objectives, risks, charges, and expenses associated with 529 plans. More

information about specific 529 plans is available in each issuer’s official

statement and applicable prospectuses and can be obtained from your financial professional. Also, before investing consider whether your state offers a 529 plan that provides residents with favorable state tax benefits. The availability of tax and other benefits** may be conditioned on meeting certain requirements. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated. For withdrawals not used for qualified higher-education expenses, earnings may be subject to taxation as ordinary income and possibly a 10% federal income tax penalty.